Npv annuity calculator

Bill Amount - The amount of your bill for dinner uber hairstylist or whatever the case may be. NPV Calculator Click Here or Scroll Down Net Present ValueNPV is a formula used to determine the present value of an investment by the discounted sum of all cash flows received from the project.

Annuity Formula What Is Annuity Formula Examples

It supports both irregular length periods and exact date data entry.

. An annuity is an investment provided by insurance companies. Get 247 customer support help when you place a homework help service order with us. Present Worth of a future sum of money or stream of cash flow based on the rate of return discount rate and the investment term.

It is much more powerful and flexible than most HELOC calculators that you. Home financial present value calculator. Assuming your capital budget is 7 million Project A requires 10 million and produces an NPV of 2 million.

I generally do not advocate getting a home equity line of credit see my home equity loan spreadsheet but if you already have one the Line of Credit Calculator spreadsheet below may help. Investment appraisal techniques are also known as capital budgeting techniques. A stream of cash flows that includes the same amount of cash outflow or inflow each period is called an annuity.

Annuities serve the purpose of stable and predictable retirement income for those that are near or in retirement. An NPV calculator is a valuable tool for investors and businesses considering undertaking a project. For example a car loan or a mortgage is an annuity.

Annuity Rate of Return Calculator. In finance the equivalent annual cost EAC is the cost per year of owning and operating an asset over its entire lifespanIt is calculated by dividing the NPV of a project by the present value of annuity factor. We hope you find this tip calculator useful in all your culinary adventures as well as any other places a tip is required.

Annuity - Present Value. When each periods interest rate is the same an annuity can be valued. PVB2B7 B3B7 B4 B5 B6 Assuming you make a series of 500 payments at the beginning of each quarter for 3 years with a 7 annual interest rate set up the source data as shown in the image below.

More commonly known as NPV. And the present value calculator will output the result. Tax Equivalent Yield Calculator.

Also it helps a company to choose the best project when it faces a choice between two or more products. US Health Savings Account Calculator. Each year the discount rate discounts that years cash flow back to the present value or year 0 and adds up the sum of the present value of cash flows to arrive at the net present value of all cash flows from the bond.

Free financial calculator to find the present value of a future amount or a stream of annuity payments. While the former is usually associated with learning broad financial concepts and financial calculators. The NPV function always assumes a regular annuity where payments are due at the end of the period.

However it is important to note that an investments net present value is just an estimation. Mutual Fund Fee Calculator. The present value calculator formula in B9 is.

When using a financial calculator or a spreadsheet it can usually be set for either calculation. And when youre done calculating present values then put that knowledge to use in this free 5-part video series showing you 5 Rookie Financial Planning Mistakes That Cost You Big-Time. Supports exact date cash flows easy bulk data entry saving and printing.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. NPV for a complicated series of cash flows as well as the total invested total returned and the profit or loss. Mutual Fund Fee Calculator.

Youve walked on to a car lot and someone quickly shuffles over to overwhelm you with the sales job of a lifetime. Rule of 72 Calculator. This NPV IRR calculator is for those analyzing capital investment decisions.

We will use the ordinary annuity. Savings Calculator calculate 4 unknowns. You buy it as you are after a shiny new car.

Return On Investment ROI Calculator. Alternatively EAC can be obtained by multiplying the NPV of the project by the loan. Also the NPV calculator does not guarantee returns.

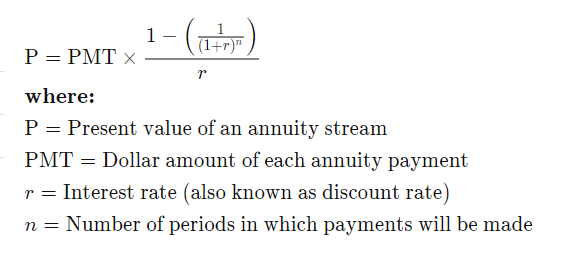

US Health Savings Account Calculator. Equivalent Annual Annuity Approach - EAA. The following formula use these common variables.

Return On Investment ROI Calculator. Value of an Annuity present value of cash flow. Capital budgeting helps an entity decide whether or not a project would offer the expected returns in the long term.

Tax Equivalent Yield Calculator. The NPV includes both the cash outflow required to purchase the bond as well as the cash inflow from the bonds sale. The NPV calculator helps to determine the net present value of cash inflows and the net present value of an investment or project.

In this case the NPV of project A and project B cant be compared for the decision-making process since the size of the 2 projects is different. Use this online PV calculator to easily calculate the Present Value aka. What is PMI and How is It Calculated.

Once we sum our cash flows we get the NPV of the project. This IRR calculator calculates an annualized rate-of-return plus profit loss. Where where r is the annual interest rate and t is the number of years.

It is important to make the distinction between PV and NPV. Rule of 72 Calculator. The calculator provides precise results.

Be careful however because the projected cash flows are estimates typically as is the discount rate. Net present valueNPV and internal rate of returnIRR are two closely related finance calculations that are used by all types of businesses to make capital projections and to decide how to allocate capital between competing investments or expenditures. If you want to calculate the present value of a stream of payments instead of a one time lump sum payment then try our present value of annuity calculator here.

Private mortgage insurance or PMI is a type of insurance typically required by the mortgage lender when the borrowers down payment on a home is less than 20 of the total cost of the home. In this case our net present value is positive meaning that the project is a worthwhile endeavor. The following formulas are for an ordinary annuity.

For the answer for the present value of an annuity due the PV of an ordinary annuity can be multiplied by 1 i. Tip Percentage - The amount you intend to tip your waiter or waitress. Download a free Home Equity Line of Credit Calculator to help you estimate payments needed to pay off your debt.

The equivalent annual annuity approach EAA is one of two methods used in capital budgeting to compare mutually exclusive projects with unequal lives. An annuity is an investment that makes payments to the investor for a period of time or until death. The formula for the discounted sum of all cash flows can be rewritten as.

There is a project B that requires 5 million and produces an NPV of 05 million. Time Value of Money Tutorials.

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of Annuity Calculation Knime Analytics Platform Knime Community Forum

What Is An Annuity Table And How Do You Use One

Present Value Calculator Sale Online 59 Off Www Wtashows Com

Present Value Of Annuity Formula With Calculator

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Excel Formula Present Value Of Annuity Exceljet

Graduated Annuities Using Excel Tvmcalcs Com

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of An Annuity Definition Interpretation

Annuity Present Value Pv Formula And Calculator Excel Template

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Present Value Of A Growing Annuity Formula With Calculator

Present Value Annuity Factor Formula With Calculator

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Annuity Due Formula Example With Excel Template

Present Value Of An Annuity How To Calculate Examples